Onestart Business Centre provides you with professional insurance and MPF service, including:

-

MPF member registration and asset transference service

-

MPF personal accounts consolidation service

-

Employment insurance and General insurance (including Liability insurance and Fire insurance)

-

Annuity plan (Steady stream of GUARANTEED monthly annuity payments for retirement)

Advantages of our service:

-

One-stop company registration services

-

Reliable insurance and MPF service provided by corporate instead of individuals

-

Easy and convenient application

What is MPF

The Mandatory Provident Fund (MPF) is a compulsory saving scheme for the retirement of residents in Hong Kong, in which a monthly contribution to MPF schemes is required for most employers and employees according to their salaries and the period of employment. Starting from December 2000, except for exempt persons, employees and self-employed persons aged 18 to 64 are required to join an MPF scheme.

Guidelines for the employees - Member enrolment

Within 60 days of their employment - for the enrolment of all non-casual employees aged between 18 to 65, engaging in full-time or part-time jobs for a continuous period of not less than 60 days

Within 10 days of their employment - for all casual employees

i.) employed on a day-to-day basis or for fixed period less than 60 days; and

ii.) engaged in the construction or catering industry

Should an employee terminate his/her employment with your company, the employee must

i.) Notify the trustee of the member’s termination within 10 days of the end of the calendar month in which it occurred; and

ii.) Settle the last contributions for the terminated member

Who is exempted?

-

Any person from overseas who enters Hong Kong for the purpose of being employed for less than 13 months, or member of an overseas retirement scheme

-

Domestic employees who provide services at home

-

Self-employed hawkers

-

Members of Occupational Retirement Schemes (ORSOs), for which exemption certificates have been granted

-

Members of statutory pension or provident fund schemes (eg. Civil servant)

-

Staff of the European Union Office of the European Commission in Hong Kong

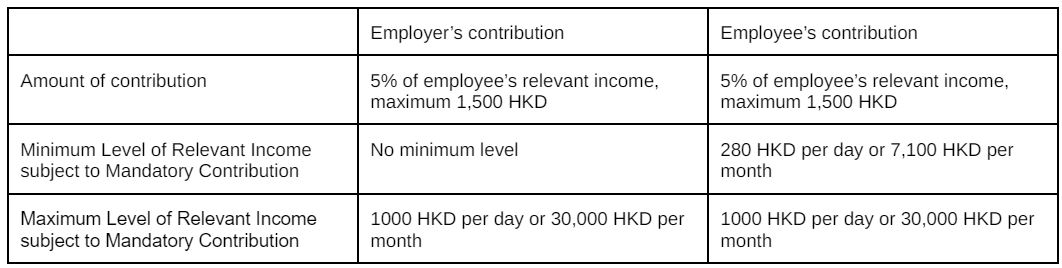

Contribution

Make sure to pay your mandatory employer’s and employees’ contributions within 10 days of each month.

Employer’s mandatory contributions for employees are payable from the first day an eligible employee starts his/her employment with your company. While each new employee is given an initial 30-day contribution holiday, he/she must pay mandatory contributions from his/her first complete calendar month or payroll cycle after such initial 30-day contribution holiday.

After each employee’s 60th day of employment, you should make first mandatory contributions for each new employee within 10 days of the following month.

i.) The minimum level of relevant monthly income of MPF contribution is 280 HKD per day or 7,100 HKD per month. In this case, only the employee is required to pay a 5% contribution of the relevant income.

ii.) If the relevant monthly income is between 280 HKD to 1,000 HKD per day, or 7,100 HKD to 30,000 HKD per month, the employee and employer are required to pay a 5% contribution of the relevant income. The maximum monthly contribution is 1,500 HKD.

iii.) If the relevant monthly income is above 1,000 HKD per day, or 30,000 HKD per month, the employee and employer are required to pay 1,500 HKD for monthly contributions.

After contribution

As an employer, you are legally required to provide each employee with a monthly pay record within 7 working days of remitting the employee's mandatory contribution.

The pay record must state:

-

Relevant income paid;

-

Employer contributions - mandatory and voluntary (if applicable);

-

Employee contributions - mandatory and voluntary (if applicable); and

-

The date of contribution payment

Changes in company information

If there is any change in company information (eg. relocation), please inform your trustee within 10 days.

If you need to offset a Long Service Payment or a Severance Payment, you are required to sign a "Offset of Long Service Payment / Severance Payment Form".

Should an employee terminate his/her employment with your company, the employee must

i.) Notify the trustee of the member’s termination within 10 days of the end of the calendar month in which it occurred; and

ii.) Settle the last contributions for the terminated member

Penalty of omission

-

Failure to enrol employees in an MPF scheme can lead to a maximum penalty of a $350,000 fine and imprisonment for three years.

-

Failure to pay mandatory contributions to MPF trustees on time can lead to a financial penalty of $5,000 or 10% of the amount due, whichever is greater.

*Resource from MPFA

Guide for the employee and self-employed

-

Under existing MPF legislation, employers must provide employees with a “pay-record” within 7 working days after making the mandatory contributions

-

To prevent the hassle resulting from multiple MPF personal accounts, members are encouraged to consolidate their personal accounts

-

Any change of your personal information must be reported to the trustee within 30 days after the change is made

-

Within 60 days of their employment - for the enrolment of all non-casual employees aged between 18 to 65, engaging in full-time or part-time jobs for a continuous period of not less than 60 days

-

Within 10 days of their employment - for all casual employees

i.) employed on a day-to-day basis or for fixed period less than 60 days; and

ii.) engaged in the construction or catering industry

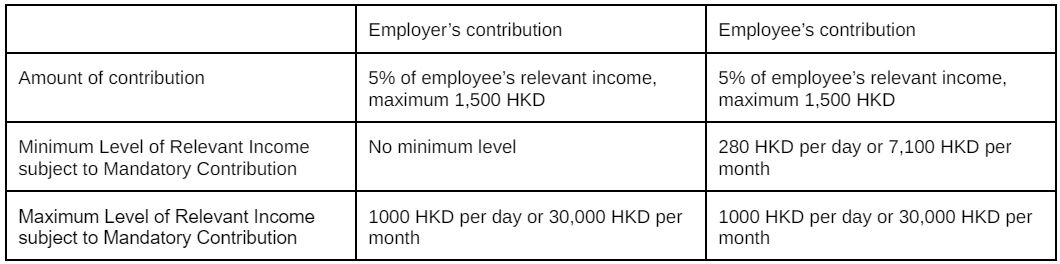

i.) The minimum level of relevant monthly income of MPF contribution is 280 HKD per day or 7,100 HKD per month. In this case, only the employee is required to pay a 5% contribution of the relevant income.

ii.) If the relevant monthly income is between 280 HKD to 1,000 HKD per day, or 7,100 HKD to 30,000 HKD per month, the employee and employer are required to pay a 5% contribution of the relevant income. The maximum monthly contribution is 1,500 HKD.

iii.) If the relevant monthly income is above 1,000 HKD per day, or 30,000 HKD per month, the employee and employer are required to pay 1,500 HKD for monthly contributions.

Company Formation

Company Formation